Part 1:

Arca

Investments Across the Recorded Music Value Chain

Key Takeaways

-

“Artists supported” refers to artists with whom labels had an active working relationship in 2023, including those receiving investment in recording, marketing, touring, or other support activities. This excludes inactive catalog artists whose past works remain part of a label’s catalog but who did not receive new investments or support during the reporting period.

Investing in Artists

Snail Mail

Part I provides a detailed look at how independent record labels invest in artists and infrastructure across the recorded music value chain.

From the moment an artist signs to the moment their music reaches audiences, independent labels provide essential financial, creative, strategic, and operational support. To better understand and quantify the nature of these investments, we have organized a wide range of label activities into five overarching thematic areas.

These groupings reflect how investment flows through core business functions. Each represents a bundle of related operational areas that, together, reflect the different ways labels enable and sustain artist development and audience connection. They are:

#1 Artist Relations and Strategic Support

Long-term strategic support for artists.

#2 Artist Creative Development and Production

Investment related to supporting artists towards writing, producing, recording, and refining music and other creative content before it is released.

Cryymm

#3 Artist Marketing, Distribution, and Visibility

Encompassing the many functions involved in putting artists' music in front of audiences, including marketing and promotion, digital licensing, distribution, and physical manufacturing.

#4 Live Performance and Touring

Supporting artists as they tour, undertake promotional appearances and perform.

#5 Organizational Infrastructure and Capacity

Operating costs to sustain label infrastructure and capacity, including overheads.

These areas of activity are interdependent, where success in one area depends on strategic investment in others. Our approach surfaces how label resources are distributed across the value chain and, in doing so, highlights the range of jobs, skills, and infrastructure that independent labels activate and sustain in support of artists.[7]

-

We recognize that labels are not the only ones contributing to artist development; other partners, including managers, aggregators, distributors, booking agents, publishers, publicists, and others play important roles alongside labels. While this report focuses specifically on label activity, we acknowledge the vital contributions of these collaborators, which fall outside the scope of the figures presented here.

In 2023, the nine participating labels invested a combined ~$134m. On average, this amounted to $236K per artist supported, reflecting a significant financial commitment that underscores the depth of engagement these labels maintain with their rosters.[8] This level of per-artist investment highlights the high-touch, long-term approach that independent labels take in nurturing talent. Rather than relying on short-term returns or viral success, these labels make ongoing investments across multiple areas, with the aim of building sustainable careers.

This model reflects a willingness to share risk with artists and to invest in projects that may take years to yield returns, signaling a fundamentally different orientation from volume‑driven models. It also points to the crucial role that independent labels play as incubators of both creative and economic value within the music ecosystem, serving not just as financiers, but as committed partners in long‑term artist development.

In 2023, the nine participating labels invested a combined ~$134m, translating to an average of $236k in support for each of their artists.

While we did not measure direct and indirect downstream economic impacts in this study, we know that label investments also generate substantial benefits beyond the artist-label relationship itself. Label investments support a wider network of creative workers and small to medium-sized businesses across the music ecosystem. This includes producers, recording studios, publicists, marketing and radio promotion companies, video directors and crews, graphic designers, photographers, digital platforms, lawyers, accountants, and more. These investments also produce indirect economic benefits, enabling touring, merch sales, sync, and live performance activity that sustains venues, promoters, crew, booking agents, managers, and publishers. In this way, independent labels act as anchors in a much larger chain of economic activity and employment within the music sector. To illustrate this ripple effect in concrete terms, we have also included a cost breakdown from one album campaign by ORCA member label Hopeless Records, showing how a single release can mobilize investment and create value across the broader ecosystem.

Barry Can’t Swim

Overall Labels Costs (%) USD $134,395,936

The largest share of label investment, 46.8% ($62.9m), was directed toward organizational infrastructure and capacity, underscoring the essential role that experienced teams and operational systems play in sustaining long-term artist development. This spending enables labels to retain the strategic expertise and industry-specific knowledge of staff that comes from years of experience navigating the complexities of the music business. The second-largest share of investment, 36.4% ($48.9m), was allocated to artist marketing, distribution, and visibility, highlighting the level of resources required to help artists break through and reach audiences, and build sustainable careers in an increasingly saturated music marketplace.

In the sections that follow, we examine each thematic area in more detail.[9]

-

In 2023, the participating labels supported a total of 569 artists across all stages of the recorded music value chain. This includes artists who received active support from the participating labels during 2023. It does not include inactive roster artists. The $236k per artist figure reflects investments across all key areas covered in this report, including “organizational infrastructure and capacity”, which accounts for label operating costs and overhead. This category is included because it represents long-term investment by labels in both the physical and human capital that supports artists over time.

-

Each area of the value chain in this report includes an “other” category, shown only as a percentage of category spending in the accompanying pie charts. While we are unable to break these costs down into specific line items, they were reported by participating labels as part of their overall spending. The presence of these “other” categories reflects the diversity and complexity of independent label operations, It also reflects differences in internal accounting practices across labels, which in some cases made it difficult for the reporting labels to cleanly assign certain expenditures to a specific category of the artist development process, as we defined it. Nonetheless, these costs remain an important part of how labels resource their relationships with artists, and support a wide range of activities that contribute meaningfully to long-term partnership and support for artists.

Hopeless Records

Third party costs analysis

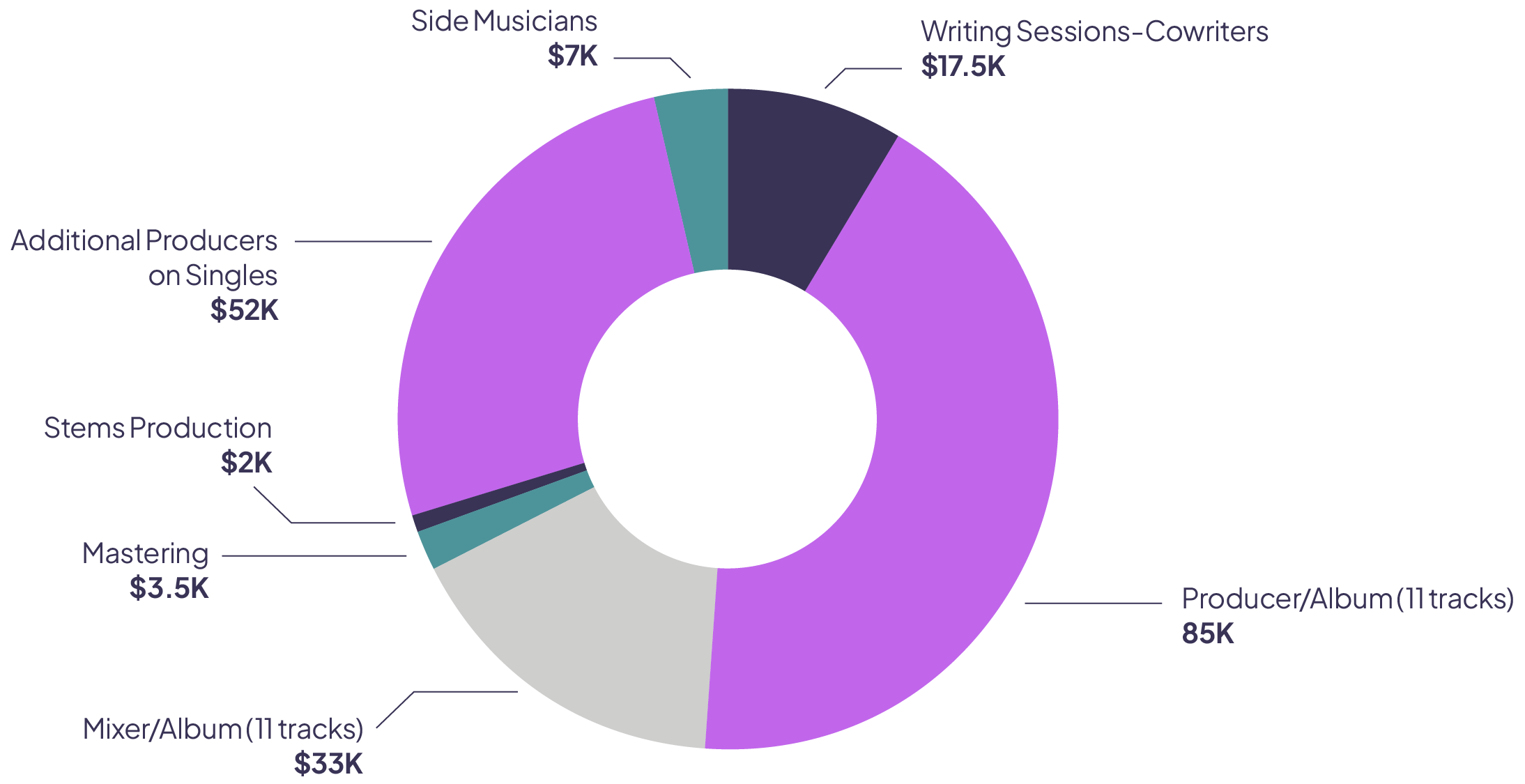

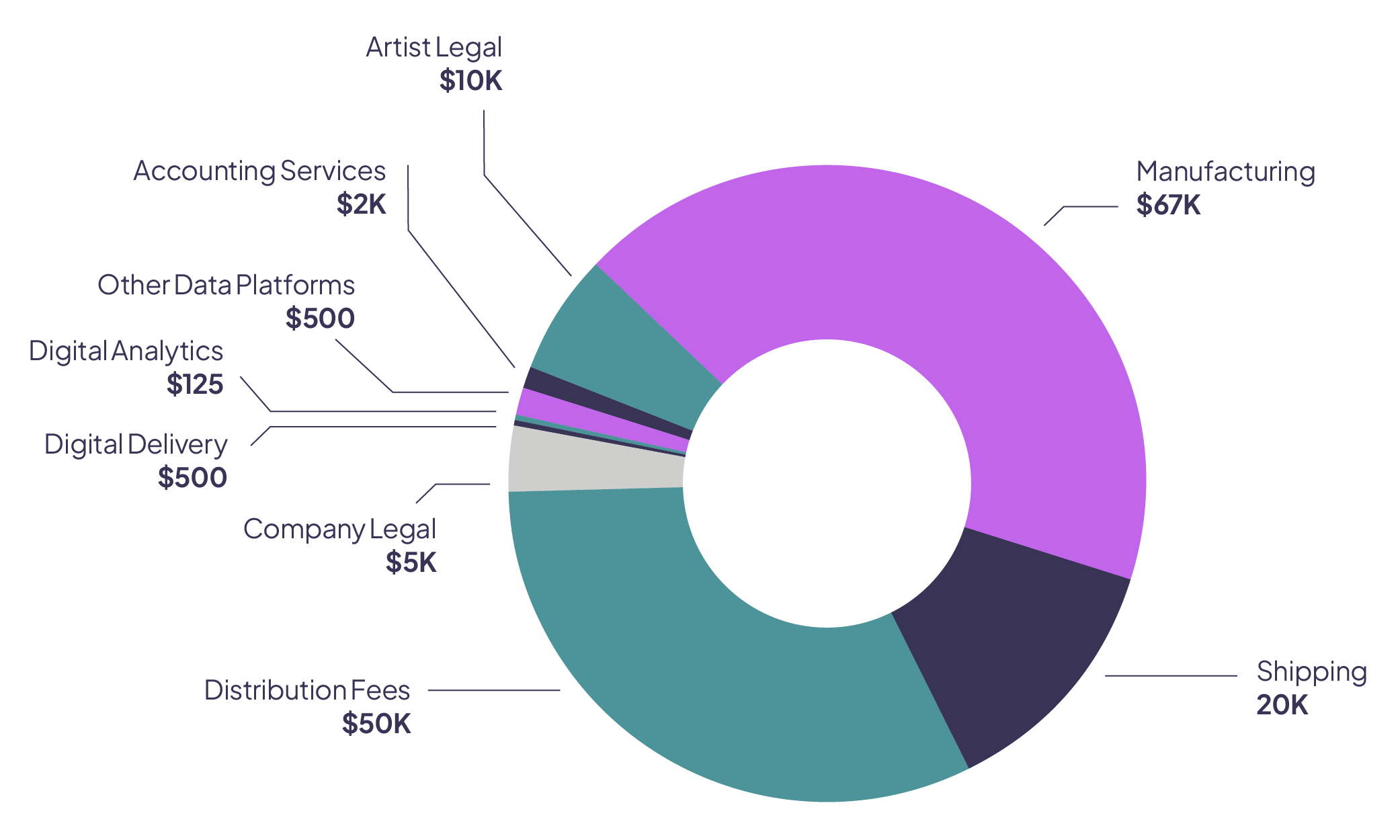

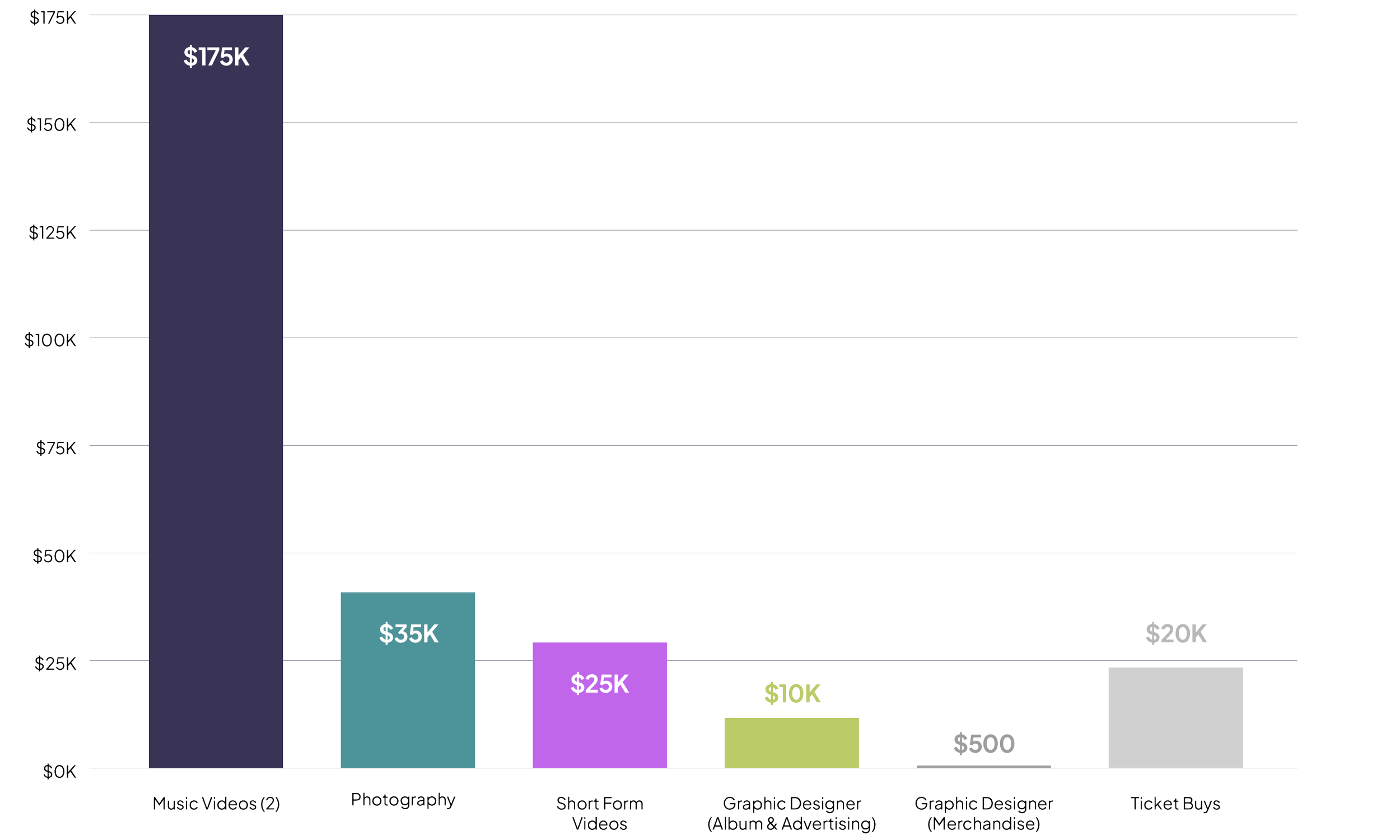

Below, we present a detailed breakdown of the costs for a single album release campaign from ORCA member label, Hopeless Records.

Third party hire outs for Recording

This case study illustrates how significant investment flows from record labels into third-party and downstream services — from production costs to marketing, promotion, manufacturing, distribution, legal, touring, and more. Mapping these expenditures provides a concrete example of how the economic benefits of a single album extend well beyond the label itself, circulating across the wider music value chain and supporting a diverse ecosystem of businesses and workers.

Other third party hire outs

Third party hire outs for Marketing (general)

Worldwide Totals (In USD): $450,000

Third party hire outs for Marketing (region‑specific)

Case Study

///////

Case Study ///////

Hopeless Records x Neck Deep

Strategic artist development through community, cohesion, and global reach

Hopeless Records’ long‑term relationship with Welsh pop‑punk band Neck Deep illustrates the label’s holistic and adaptive approach to artist development, which balances the needs of a digitally native fanbase with traditional touring infrastructure, and building an enduring narrative rooted in authenticity, community, and growth.

Neck Deep

Hopeless Records artist Neck Deep’s early trajectory followed a classic punk blueprint: heavy touring, multiple album releases, and a breakthrough via the Warped Tour circuit. But from the outset, Hopeless saw something deeper: an emerging online groundswell around the band that extended beyond live shows. As the band developed, its digital fanbase also started to grow. Reddit threads and pop‑punk forums regularly cited Neck Deep as torchbearers of the genre’s next generation, organically positioning them as cultural stewards in a scene that values both legacy and forward momentum.

Recognizing the importance of this community‑driven identity, Hopeless worked closely with the band to support a consistent narrative and fan engagement strategy that aligned across all channels, from social media and digital to physical releases, and live experiences. Rather than treat online and in‑person audiences as separate, Hopeless nurtured a feedback loop between the two: the band’s live presence fueled social buzz, while viral online moments translated into demand on the ground. As Erin Choi, General Manager at Hopeless, explains, “Even though they are different fanbases, online and in person, they really complement each other… We try to do as much as possible to connect everything together for our artists and to be as cohesive as possible.”

This hybrid strategy paid off globally. A key turning point came when the band’s song ‘Wish You Were Here’ went viral on TikTok, initially gaining traction in Southeast Asia. Hopeless was able to quickly respond and build on the momentum thanks to its international team structure. “Our regional presence allowed us to capitalize,” notes Choi. With local label managers based in key territories, including Southeast Asia, Hopeless had on‑the‑ground teams who acted as release managers. Their work helped ensure the viral moment translated into real‑world impact, culminating in a festival headlining performance for 50,000 fans in Indonesia.

By treating artist development as an ongoing, multidimensional process that is grounded in long‑term strategy, cross‑platform storytelling, and cultural listening, Hopeless has helped Neck Deep evolve from grassroots beginnings to global relevance. It’s a model rooted not only in marketing expertise, but in genuine partnership, flexibility, and faith in an artist’s potential.

“Even though they are different fanbases, online and in person, they really complement each other… We try to do as much as possible to connect everything together for our artists and to be as cohesive as possible.”

Erin Choi, General Manager at Hopeless

Artist Relations and Strategic Support

Smith & Thell

What is artist relations and strategic support?

Artist relations and strategic support refers to the strategic, financial, and operational backing that labels provide to artists from the outset of their relationship. It includes:

Business Affairs Support

Support towards managing business affairs, licensing agreements, protecting intellectual property, handling contract negotiations, and ensuring legal and financial compliance.

Global Inter‑connectivity Support

Support to facilitate global collaborations and opportunities (both creative and business‑related) for artists.

Artist Services & Strategic Support

Support that offers artists access to a variety of resources, such as dedicated data and development portals for real‑time updates, strategic guidance across artist and audience development, and career development tools.

Other Artist Relations and Strategic Support Costs

Artist Relations and Strategic Support (ARSS) Investment Breakdown

Of the ~$134m in total label costs reported, 6.7% was spent on ARSS-related activities, amounting to $9.1m.[10]

This translates to an average investment of approximately $135K per artist on ARSS‑related activities in 2023.[10]

Here, we break down ARSS‑related costs by sub‑category.

In 2023, ORCA member labels invested an average of approximately $56.9K per artist in supporting ARSS‑related activities.

Artist Relations and Strategic Support Costs (%) USD $21,370,685

-

The 12.1% of total label costs (~$177m) allocated to ARSS-related activities is broken down into several subcategories. The breakdown of these sub-categories relative to total label costs is as follows: upfront investment (7%), other ARSS-related costs (2.53%), business affairs (1.52%), global inter-connectivity (0.96%), and artist services and strategic support programs (0.08%).

-

On average, 20% of ARSS-related investments were designated as recoupable costs in 2023. Upfront advances made up the largest share of these, with 80% of advance spending deemed recoupable, compared to just 5% for business affairs, 14% for artist services and strategic support, and 0% for global interconnectivity.

-

In 2023, the participating labels provided 159 artists with ARSS-related support.

Other Investment

This category captures the core, day-to-day strategic work labels do that falls outside that direct work with artists captured by the artist services and strategic support category below. It includes internal coordination and relationship management, and flexible, non‑campaign-specific spending that underpins long-term artist development. These costs are classified by the labels as “other” because they are diffuse, ongoing, and cross‑functional. They often span multiple projects, departments, or timeframes and therefore don’t fit neatly into more discrete budget lines.

Independent label deals reflect a holistic and developmental approach. As Eric Tobin, EVP of Business Development and A&R at Hopeless Records explains, “To develop an artist in this community it takes about three to five years and that deal has to be meaningful enough that we have the time, because we’re offering to develop careers here.” The three to five year development period reflects the long-term, layered approach independent labels take to building careers. This includes refining an artist’s sound, developing a sustainable release and touring strategy, building a core team, and growing a dedicated audience.

Of the $9.1m invested in ARSS-related activities, the largest portion, 50.9%, was allocated to other ARSS-related costs.

Bye Parula

“To develop an artist in this community it takes about three to five years and that deal has to be meaningful enough that we have the time, because we’re offering to develop careers here.”

Eric Tobin, EVP of Business Development and A&R, Hopeless Records

“Our commitment is not to records, it’s to careers.”

Bruce Iglauer, Founder and President, Alligator Records

The focus is on career longevity and creative independence, rather than short-term returns. Strategic support provided by labels facilitates that commitment by providing artists with the resources to focus on the most vital part of their career: the creative work itself. This includes not only making music and building a compelling artistic world, but also working with their manager, or if managing themselves, to grow their team, pursue strategic opportunities, and lay the foundation for long-term career development.

This philosophy of long-term, strategic investment as a foundation for partnership with artists aligns with the broader values of independents. Bruce Iglauer, Founder and President of Alligator Records, sums it up: “Our commitment is not to records, it’s to careers.” Labels are not placing financial bets; they are building infrastructure around artists, providing both the means and the time to grow audiences and lay the groundwork for long-term success.

Of the $9.1m invested in artist relations and strategic support (ARSS), 50.9% was allocated to other ARSS-related costs.

Kassian

Business Affairs & Global Inter‑connectivity

In 2023, business affairs and global inter‑connectivity investments together accounted for over 47.5% of total ARSS‑related expenditures among participating labels. Business affairs comprised 28.7% ($2.6m), while global inter‑connectivity represented 19% ($1.7m).

Though distinct, these two areas work hand in hand: business affairs provides the legal, financial, and licensing expertise foundational to artist development, while global inter‑connectivity ensures support and success extends across international markets.

With many emerging artists entering the industry without formal management, independent labels frequently play a supportive and consultative role, helping artists understand the industry landscape and make informed decisions. “We’ve had to become expert advisors,” explains Kris Gillespie, Managing Director at Domino, reflecting on the breadth of label support that helps artists navigate external partnerships, build their teams, and assess opportunities in line with their long‑term goals and values.

With many emerging artists lacking formal management, independent labels frequently take on an advisory role, helping artists navigate the complexities of the industry.

This strategic alignment also extends globally. Labels like Secretly Group and Hopeless Records, for example, maintain distributed teams that enable territory-specific marketing, licensing, and media outreach. Secretly has staff across Australia, France, Germany, The Netherlands, the UK, and US; Hopeless employs seven regional label managers spanning markets from Southeast Asia to Europe. These teams act as local release managers, handling everything from album marketing to managing local music media and promotion.

Beggars Group maintains a similar framework. Simon Wheeler, Director of Global Commercial Strategy, explained that his team manages around 200 digital partnerships worldwide, which play a critical role in helping artists reach new audiences by expanding their presence across a wide range of digital platforms and markets. “I think it's key to approach anything by trying to see the opportunity rather than the threat first. There may be both, but we try to approach the opportunity while being mindful of the risks. We try and think, what do we want to do? How do we want to do it? What does it mean for our artists?”

Madres

Artist Services and Strategic Support

Baby Rose

In 2023, artist services and strategic support accounted for 0.7% ($147K) of total ARSS‑related expenditures across participating labels. While modest in financial terms, this figure reflects a focused set of activities, such as access to data and analytics tools, digital training, business and strategic planning support, and coordination with managers and team members, that play a critical role in long‑term career building.[12]

Independent labels help artists and their teams structure career development, access and interpret platform data, and coordinate efforts. As Magnus Martinsson, the Head of Digital Operations at Playground Music explains, “We educate both the other team members and artists, making sure they have all the tools and information needed to strategically plan,” from high‑level strategy to practical audience development skills like managing YouTube channels or using Spotify playlists.

Effectively, artists and their teams are able to tap into the valuable, accumulated expertise of labels and their staff, as a resource for informed decision making and long-term planning. At independent labels, staff continuity builds a base of knowledge from past campaigns that serves as a strategic resource for artists.[13] This gives artists access to lessons and insights that might otherwise take years to gain on their own. “Even in the short term, you might learn something on a project and try to apply that on an upcoming project,” explains Jessica Park, Global Label Director at Secretly Group.

This type of support is collaborative by design. As Kris Gillespie of Domino recalls, independent labels have long operated with a “hands‑on, all hats” ethos, where business affairs, strategy, and creative support are deeply interwoven. This tradition, rooted in trust and close collaboration, continues to shape how independent labels contribute to artist careers.

-

Label support for artist career development extends far beyond this cost category alone. Substantial related support is also embedded across other key investment areas covered in this report, including marketing, creative development services, A&R development, and more.

-

According to WIN, 42% of staff at independent music companies have worked there since the launch of the label, a stat made more impressive by the fact that the average independent label is 14.9 years old.

LydiaLoveless

Artist Creative Development and Production

What is artist creative development and production?

Artist creative development and production refers to the creative, technical, and developmental backing that labels provide to help artists create, refine, and present their music and public image. It includes:

Artist and Repertoire (A&R) Development

Support provided by labels to identify and develop emerging artists, including scouting talent, building early relationships, and guiding creative direction prior to signing. Activities may include attending live shows, initiating songwriting and collaboration discussions, and planning long-term artistic and release strategies to ensure alignment and sustainable growth.

Recording Support

Support provided by labels for the recording and production process, including providing artists with access to studios, overseeing the production process, and managing the mixing and mastering of tracks to ensure the final product meets professional standards.

Creative Development Services

Support provided by labels for development of creative and promotional assets such as music videos, social media content, photoshoots, and providing styling support and other materials that help strengthen an artist’s public image and fan engagement.

Other Creative Development and Production Costs

Artist Creative Development and Production Breakdown

Of the ~$134m in total label costs reported, 9.6% was spent on ACDP-related activities, amounting to $12.9m.[14]

This translates to an average investment of approximately $52.7k per artist on ACDP‑related activities.[15]

Here, we break down ACDP-related costs by sub‑category.

In 2023, ORCA member labels invested an average of approximately $52.7K per artist in supporting artist creative development and production‑related activities.

Artist Creative Development and Production Costs (%) USD $12,908,983

Bully

-

The 9.6% of total label costs (~$134M) allocated to ACDP-related activities is broken down into several subcategories. The breakdown of these sub-categories relative to total label costs is as follows: Artist and Repertoire (A&R) development (3.4%), recording support (1.6%), creative development services (4.5%), and other artist development costs (0.2%).

-

On average, 26% of ACDP-related investments were designated as recoupable costs in 2023. Recording support accounted for the largest portion, with 44% of spending in this category deemed recoupable. A&R development and creative services were designated as recoupable at lower rates of 22% and 32%, respectively.

Creative Development Services, and Artist & Repertoire (A&R) Development

Of the ACDP-related investment, 47.1% ($6.1m) was allocated to creative development services, and 34.9% ($4.5m) went toward A&R development. Together, these two categories represent over 80% of spending in this area, highlighting the label’s active role in shaping not only the sound of their artist’s work, but also how it is developed, positioned and connected to audiences.

A&R development forms the early creative and relational foundation of the label-artist partnership, typically anchored by a dedicated A&R representative. This stage often begins well before any formal signing, as labels identify promising artists and begin supporting their creative growth. A&R development involves scouting and relationship building, including attending live shows, meeting with emerging artists, and exploring potential alignment with the label’s values and roster. Early conversations often cover songwriting direction, possible collaborators, long-term artistic goals, and release strategies. Labels frequently begin this work to ensure mutual fit and shared vision before any contracts are signed or advances paid. “We go through and talk about what it is that we're planning for the whole year or the next 18 months,” says Erin Choi of Hopeless Records. “The whole thing for us is that everything's going to move at a different pace… It doesn’t need to be an overnight success.”

Creative development services build on this foundation once the partnership is formalized by extending and amplifying the creative vision expressed in an artist’s music. These services shape an artist’s visual and cultural presence through music videos, photoshoots, styling, concept development, and more. Tim Putnam, Co-founder and President of Partisan Records, expands on this approach: “You don’t nurture art, you nurture artists… Our job is ‘how do we become fluent in the language of each artist’ so we can teach it to audiences.”

“You don’t nurture art, you nurture artists… Our job is ‘how do we become fluent in the language of each artist’ so we can teach it to audiences.”

Tim Putnam, Co‑founder and President, Partisan Records

Debby Friday

“Typically the concept is what we're going to go out and bring to potential fans. This, for us, is a lot of world building, brand building, and fan building… Where do we want the visuals to go? How do you want to get on tour? Who are you going to tour with?”

Eric Tobin, EVP of Business Development and A&R, Hopeless Records

As Eric Tobin of Hopeless Records adds: “Typically the concept is what we're going to go out and bring to potential fans. This, for us, is a lot of world building, brand building, and fan building… Where do we want the visuals to go? How do you want to get on tour? Who are you going to tour with?” Product managers are often brought in early to lead this process, helping to translate the artist’s vision into a coherent and resonant package. Working in tandem with marketing and promotion, A&R, and management, they coordinate everything from rollout timelines to digital touchpoints, ensuring that the music is supported by a compelling and cohesive creative narrative.

“We're looking at a lot more data than an artist can do on just their own socials, and this is one of the key things that a label can offer.”

Jessica Park, Global Label Director, Secretly Group

This collaborative approach is grounded in an understanding of how audience attention is earned and sustained. “Some artists may come to us and do not have the understanding of what works on socials,” explains Jessica Park of Secretly Group. “We're looking at a lot more data than an artist can do on just their own socials, and this is one of the key things that a label can offer.” This includes not just content creation but also translating technical performance data into actionable strategy. As Erin Choi of Hopeless notes, the team often steps in to explain how specific creative work interacts with DSP algorithms, playlist placement, and audience behavior: “A lot of people are like, ‘I want to put out a song every two weeks.’ And we’ll go in and say, ‘That’s actually not going to work well that way.’” In this sense, creative development services serve not only to refine visual identity but to educate, guide, and align the full artist team behind a clear and coordinated plan.

Recording Support

Label investment in supporting artist recording costs, including directly financing studio time and production, represents 16.5% ($2.1m) of total ACDP-related expenditures. For many labels, this means more than simply covering studio fees; it involves creating the right environment for artists to do their best work. This can include facilitating access to inspiring, comfortable environments, helping artists assemble the right team of collaborators, and offering hands-on support throughout the recording process. Independent labels are often distinguished by this deep level of personalized, artist-first support that goes beyond just covering costs, to helping create a space where artists can truly thrive creatively.

Ezra Collective

“The band just put it on. They played in a way… it was just different. And you were capturing that feeling in the room that was suddenly opening up something in them… It was just absolutely amazing.”

Tim Putnam, Co-founder and President, Partisan Records

This philosophy is brought to life in how labels shape and support the creative process itself. Tim Putnam of Partisan Records recounts how during the recording of Dance, No One’s Watching at Abbey Road Studios, the label surprised the Mercury-Prize and Brit Award winning artists Ezra Collective by inviting people who mattered most to them, including friends, family, mentors, and even footballers they admired, to be present in the session. “The band just put it on. They played in a way…it was just different,” he recalls. “And you were capturing that feeling in the room that was suddenly opening up something in them… It was just absolutely amazing.” You can hear the audience on the final recording. It’s a vivid example of how recording support isn’t just about studio logistics, but about crafting meaningful creative conditions that allow artists to fully express themselves.

Other labels take a more structural approach, and have invested in permanent infrastructure to achieve similar aims. Playground Music, for example, operates a professional in-house facility, Roxy Recordings Studio, in central Stockholm. The space is made available flexibly to signed artists and serves as a hub for creative exchange. The studio has played a tangible role in enabling artistic and commercial success. During a visit to Stockholm, the northern Sweden-based band Hooja used the space to record a high-profile collaboration with Miriam Bryant, which went on to top both Spotify and national charts in Sweden. The space is also regularly used by writers and producers like Smith & Thell, who draw on the studio not only for their own projects but as a base for collaborative songwriting with other artists.

Maintaining this type of shared studio space, according to Mårten Aglander, Managing Director at Playground, deepens the artist-label relationship and enables creative interaction that goes beyond scheduled sessions. While not a direct revenue driver, this investment in recording infrastructure fosters high-quality production, strengthens artistic community, and lays the groundwork for long-term success.

Artist Marketing, Distribution and Visibility

Hot Chip

What is artist marketing, distribution and visibility?

Artist marketing, distribution, and visibility refers to the commercial, logistical, and promotional activities that labels undertake to bring artists’ music and brand to market. It includes:

Global Distribution

Support provided by labels towards ensuring artists' music and goods make it to audiences worldwide, including licensing music to DSPs and other digital platforms, manufacturing CDs and vinyl records, and distributing merchandise.

Marketing

Support provided by labels towards marketing artists and their music effectively, including developing and executing release campaigns, utilizing digital and physical media channels, conducting audience analysis, and developing customer relationship management (CRM) strategies.

Promotion

Support provided by labels towards obtaining and executing direct promotional campaigns for artists and their music, including media features and performances (TV, radio, print/digital media, in-store, podcasts, streaming, and more).

Artist Brand Opportunities

Support provided by labels for commercial and brand‑related development including pursuing sync opportunities for music placement in film, television, advertising, and games; establishing brand partnerships; developing merchandise lines; and leveraging emerging technologies to expand an artist’s reach and diversify revenue streams.

Other Artist Marketing, Distribution, and Visibility costs

Artist Marketing, Distribution, and Visibility Breakdown

Of the ~$134m in total label costs reported, 36.4% was spent on AMDV-related activities, amounting to $48.9m.[16]

This translates to an average investment of approximately $110K per artist on AMDV‑related activities in 2023.[17]

Here, we break down AMDV-related costs by sub-category.

In 2023, ORCA member labels invested an average of approximately $156K per artist in supporting artist marketing, distribution, and visibility‑related activities.

Artist Marketing, Distribution and Visibility Costs (%) USD $48,857,579

Sampha

-

The 36.4% of total label costs (~$134M) allocated to AMDV-related activities is broken down into several subcategories. The breakdown of these sub-categories relative to total label costs is as follows: global distribution (18.3%), marketing (10.1%), promotion (4.6%), artist brand opportunities (0.5%), and other costs related to the commercial success of the artists (2.9%).

-

In 2023, the participating labels provided 444 artists with AMDV-related support.

Global Distribution

Global distribution activities represent the largest share, 50.2%, of AMDV-related costs for labels, totalling $24.5m. This substantial investment underscores the critical role of distribution in delivering music, visuals, and merchandise to audiences worldwide. It includes both digital distribution through DSPs and physical manufacturing and logistics, reflecting the complexity and scale of getting music to market. Manufacturing products is a significant outlay for independent labels, reflecting the higher percentage of costs associated with distribution. This is much more than simply getting music to where it needs to be. This is about building a supply chain and global network that prioritizes content, creates relationships and manages rights.

As Tim Roddis of Beggars Group puts it, “It’s the work that gets people paid properly and it’s got to be right.”

“It’s the work that gets people paid properly and it’s got to be right.”

Tim Roddis, Global Head of Digital Operations, Beggars Group

Distribution is far from passive; it requires ongoing oversight and specialized expertise. To manage this complexity, independent labels have invested in expert digital teams to manage operations, DSP relationships as well as content delivery, metadata, and IP protection. “Distribution is not a hands-off thing,” explains Tim Roddis, the Global Head of Digital Operations at Beggars Group, “you're making sure that the pipeline is solid, the data is coming back, the pay is coming back.” Magnus Martinsson, the Head of Digital Operations at Playground Music, echoes this when discussing their distribution pipeline, noting, “We want to give every release the best possible setup and possibility of success from the start.”

In parallel, physical distribution remains vital for independents, especially those with strong vinyl and collector markets. This involves managing manufacturing, inventory, and global shipping across multiple territories and formats, nourishing relationships with key retailers and supply chain sub-contractors, requiring meticulous coordination with retailers and fulfillment partners. This part of the supply chain is critical to ensuring that artists’ work is accessible in the formats their audiences value most.

“Distribution is not a hands-off thing. You're making sure that the pipeline is solid, the data is coming back, the pay is coming back.”

Tim Roddis, Global Head of Digital Operations, Beggars Group

Marketing, Promotion and Artist Brand Activities

Marketing costs represent the second-largest area of AMDV-related spending at 27.8% ($13.6m), encompassing release campaigns, media channel management, influencer initiatives, and other audience engagement strategies. Promotion accounts for another 12.7% ($6.2m), focused on securing media coverage and engagement boosting activities like performance opportunities across platforms such as TV, radio, podcasts, and streaming services. Smaller, but still important is artist brand development investments representing 1.5% ($708K), including development of sync placements, managing merchandise, and pursuing brand partnerships. Combined, these three areas account for over one-third of total AMDV‑related investment, reflecting a tightly linked set of activities that work together to elevate artist visibility, shape narrative, and cultivate long-term fan relationships.

“We’re not really about overnight success… we want to make sure that artists’ creative vision is fulfilled.”

Erin Choi, General Manager, Hopeless Records

Marketing and promo teams at independent labels are often small but specialized, bringing together product management, campaign planning, and territory coordination, to create multi‑platform campaigns that evolve over time, and are tailored to each artist’s trajectory. “We’re not really about overnight success,” says Erin Choi, General Manager at Hopeless Records. “We want to make sure that artists’ creative vision is fulfilled.” Campaign development is a highly collaborative process, with teams working closely with artists to define goals, messaging, and timelines: “We start off pretty early, even before a band or an artist goes into the studio,” explains Choi. “We talk about what we’re planning for the year, what milestones we want to hit, and how everything can move at a pace that suits the artist.”

Data helps guide decisions, but labels emphasize translating it into practical insights for artists: “Our promo department spends a lot of time looking at what’s driving the needle,” says Choi, “and then we package it in less technical ways so we can advise artists on release timelines, what content to prioritize, or how to leverage tools like algorithmic playlists.” As Jessica Park, the Global Label Director at Secretly Group puts it, “Across all things we’re trying to help them start off on a really good base for a campaign.”

Sync licensing is just one of the many promotional avenues that labels pursue to grow artists’ reach and revenue. Labels open doors to sync and brand opportunities by cultivating deep, trusted networks across film, TV, advertising, and gaming. “So much of this work is making sure people know you, and know your releases and new signings,” explains Catie Ginsburg, Global Director of Sync and Partnerships at Partisan Records. Labels also work to turn sync placements into campaign-building moments that grow audiences. As Justin West, the President and CEO of Secret City Records notes, “It’s how you build around the sync. It’s the work that's required to capitalize on these things and how we utilize that to drive records and break careers that really matters.”

“It’s how you build around the sync. It’s the work that's required to capitalize on these things and how we utilize that to drive records and break careers that really matters.”

Justin West, President and CEO, Secret City Records

Bonobo

Live Performance and Touring Support

What Is Live Performance and Touring?

Parcels

Live performance and touring refers to the logistical, financial, and strategic assistance that labels provide to help artists perform and build audiences through live events. It includes:

Artists Live Performance Opportunities

Support provided by labels for live performance and touring including facilitating travel and accommodation, managing equipment logistics, booking venues, and covering visa and related administrative costs.

Live Performance and Touring Investment Breakdown

Of the ~$134m in total label costs reported, 0.54% was spent on live performance and touring -related activities, amounting to $730K.[18]

This translates to an average investment of approximately $3.7K per artist on live performance and touring related activities.[19]

It must be noted here that this does not include the broad range of investments labels make related to touring, which includes ticket buys and marketing to support touring. These are captured in other investment categories and reflected in the total amount. Regardless, we recognize the work of other partners in facilitating and developing this business area, including managers, agents, promoters, tour managers, venue staff and equipment suppliers, among others. Despite the risks, touring remains one of the most effective ways to build an audience, generate long-term momentum, and ultimately, unlock sustainable revenue. As such, early touring support functions as a direct investment into an artist’s future career and while modest in this specific framework, the timing of this investment - noted here and in general - and its impact are significant.

Unlike recorded music revenues, touring income including performance fees typically fall outside standard label contracts, meaning labels rarely see direct financial return on these investments. This helps explain the modest spending observed in our data.

Nonetheless, independents continue to provide informal and formal touring support because of its broader development value. “There’s a lot of logistical support that we provide for the tours,” says Kris Gillespie, Managing Director at Domino. “It’s using the tour to market the album, but also, it's just part of the support that labels provide, because we are trying to coordinate all of our efforts so that they’re all pushing in the same direction.”

“There’s a lot of logistical support that we provide for the tours… It's marketing the album and using the tour to market the album, but also, it's just part of the support that labels provide, because we are trying to coordinate all of our efforts so that they’re all pushing in the same direction.”

Kris Gillespie, Managing Director, Domino

-

In 2023, the participating labels provided 198 artists with live performance and touring-related support.

-

The investment made per artist on live performance and touring related activities varies based on the specific circumstance of each artist. For example, non-American artists travelling to the United States typically incur higher costs than artists touring and trying to break careers in their domestic home territory.

Organizational Infrastructure & Capacity

Father John Misty

What Is Organizational Infrastructure & Capacity?

Organizational infrastructure & capacity refers to the operational and administrative foundation that enables labels to function effectively and deliver consistent support to artists across their careers.

This category encompasses label overhead, with costs related to operational infrastructure such as office rental, staff salaries, administrative functions, and technology development. It also includes label costs towards risk management and compliance including liability insurance to ensure legal and operational protection for both the label and the artists they represent.

Organizational Infrastructure & Capacity Breakdown (Overheads)

In our analysis, the final major area of expenditure to report on is organizational infrastructure and capacity, which represents a crucial but less visible share of overall label costs. Of the ~$134m in total label costs reported, 46.8% was spent on organizational infrastructure and capacity, amounting to $62.9m. These costs are overheads and are not born by the artist, and are therefore covered by the label’s share of any deal.

This substantial share reflects the significant investment required to build and maintain expert teams. Across the participating labels, this expenditure supported the employment of 723 workers, whose roles span A&R, marketing, digital operations, and more. As detailed below, the labels in our sample stand out for their commitments to investing in employee benefits and training, and this is reflected in the costs in this category.

“It’s not about adding more data… it’s about helping people understand what they’re looking at and making faster, smarter decisions.”

Vicky Fry, Chief Information Officer, Beggars Group

Beyond headcount, this category also captures strategic investments in internal technology systems, which represent critical infrastructure in the digital era. At Beggars Group, for example, a dedicated IT development team has built in-house systems that have transformed how the label manages sales data, metadata, and digital supply chains. “It’s like a Swiss Army knife,” explains Vicky Fry, Chief Information Officer at Beggars Group, describing the suite of custom data analysis, dashboards and reporting platforms developed in-house by Beggars to support artist campaigns. This includes tools for tracking playlist performance, user-generated content spikes, and global sales analytics, all of which are critical for helping artists and marketing teams make informed, strategic decisions in real time.

These investments highlight that organizational infrastructure spending isn't just about keeping the lights on, it’s about building the strategic tools that help labels to thrive and more effectively support the development of their artists’ careers. As Fry puts it, “It’s not about adding more data… it’s about helping people understand what they’re looking at and making faster, smarter decisions” which ultimately supports stronger artist campaigns.

Geese