Part 2:

Justice

Revenues, ROI, and Artist Impact

Key Takeaways

Return on Investment and Artist Growth

Label & Artist Returns

Profit distribution

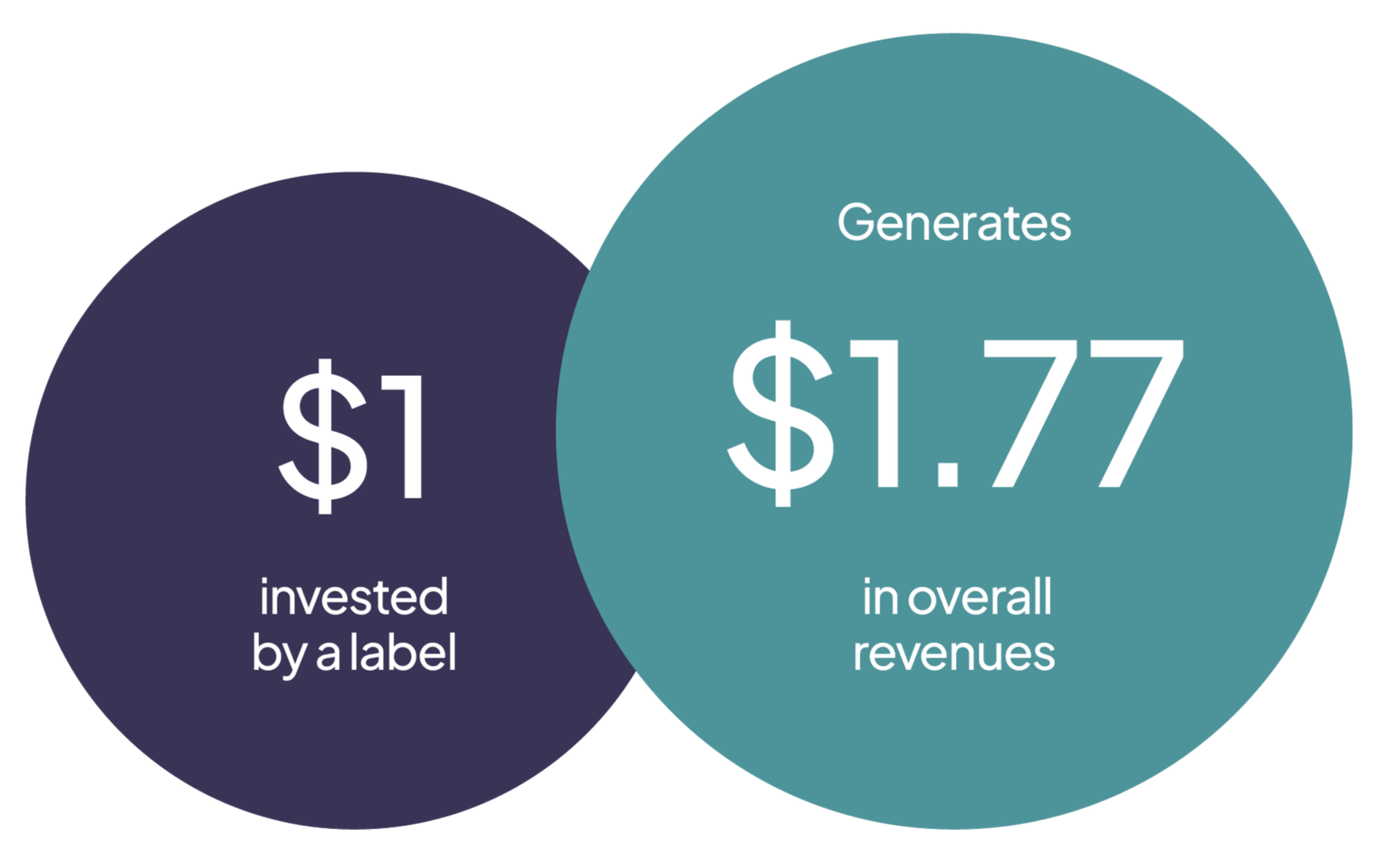

After covering operating costs, labels generated $0.77 in profit per $1 invested.

Of that profit, approximately

77%

($0.59) is paid out to artists

While the remaining

23%

($0.18) is retained by labels

Audience Growth Impact

$1 invested leads to

0.67

new Spotify followers per artist

Investment Efficiency

$236K

average investment per artist

Analysis of Impacts

Caribou

Having outlined the nature and scale of investments made by participating labels across the recorded music value chain, we now turn to the impacts label investments generate.

Part II explores how the financial, creative, and strategic support provided by independent labels translates into tangible outcomes, for both the labels and the artists. By highlighting these results, this section underscores the effectiveness and resilience of the independent label model.

Overall Revenues

In 2023, the nine participating labels generated a combined $239m in revenue, sourced from a diverse mix of income streams. Streaming revenue accounts for the largest portion at 59.5%. Physical sales revenue remains a significant contributor at 25.9%, followed by master side sync revenue at 7.4%. Other revenue sources collectively account for 5.7%, while download revenue represents a smaller fraction at 0.96%. Merchandise revenue contributes a minimal 0.48%.

This revenue composition closely reflects global trends observed in the wider independent sector. MIDiA’s 2024 State of the independent music economy report, for example, found that streaming accounted for 54% of recorded music revenues among non-major labels.[20] The slightly higher streaming share among our sample suggests a comparable, if not more pronounced, reliance on digital platforms.

Physical sales form a notable 25.9% of the income mix, a figure that is substantially higher than the global average across the recorded music sector, where physical formats accounted for 16.4% of total revenues in 2024, according to the IFPI Global Music Report. This trend holds when compared across figures for key markets: in the US, physical formats accounted for just 11% of total revenues (RIAA); in the UK, 16.5% (BPI); and in France, 19% (SNEP). This divergence reflects the particular strengths of the participating labels in vinyl sales, collector-oriented releases, and genre niches, such as electronic, experimental, and blues, where physical formats continue to hold cultural and economic value, especially among engaged fanbases.

In 2023, the nine participating labels generated a combined $239m in revenue, with the largest portion (59.5%) coming from streaming.

Every $1 invested by participating labels, generates $1.77 in revenue

Overall Revenues (%) USD $238,506,574

At 7.6% of revenues in our sample, sync also stands out as a more substantial contributor than the global average of 2.2% reported by IFPI in 2024. This pattern is again echoed across major market results: sync represented just 2% of total revenues in the US (RIAA), 2.9% in the UK (BPI), and 3.5% in France (SNEP). The higher share observed in our sample highlights the centrality of sync as a strategic revenue stream for the participating labels, reflecting both their proactive engagement with licensing opportunities and the enduring value of the catalogues they cultivate. As explored earlier in the report, sync is not only a revenue driver but also a key promotional tool that labels leverage through trusted industry networks and carefully coordinated campaigns to grow audiences.

When examined in aggregate, these revenue streams underpin a strong financial performance for participating labels. On average, the participating labels reported a return of $1.77 in revenue for every $1 invested. This 77% return highlights the overall efficiency and impact of the independent label model in generating value, including the combined effect of the diversified revenues highlighted above.[21]

The strong performance of the participating labels provides concrete evidence that independent approaches built on long-term investment and artist-first strategies are not only competitive but increasingly successful in today’s evolving music industry.[22]

-

It is important to note that this ‘non-major label’ sample includes both independent labels and independent distributors.

-

This figure reflects the overall investment of ~$134m by the participating labels in 2023.

-

As per MIDiA, ‘artists direct’ refers to self-releasing artists without a record label relationship. See: https://www.midiaresearch.com/blog/recorded-music-market-2024-362-billion-up-65

Bicep

Revenues Distributed to Artists

Investment in and return to artists is not simply a residual outcome, but a deliberate and embedded feature of the independent label model. Labels invest strategically in artist development with the understanding that value will be both generated and shared. Financial resources committed by labels are not only recouped through revenue generation, but are also shared with artists in ways that align incentives and support sustainable, long-term careers. In this model, artist success is not a byproduct of label profitability, but a primary objective built into labels’ strategic approach.

This alignment is reflected in the data. In 2023, 33.5% of total revenue across the nine participating labels was distributed directly to artists, amounting to $79.9m.[23]

The above translates to ~$0.59 in direct revenue to artists for every dollar invested by labels. This figure reflects the extent to which label spending translates into meaningful artist income. This return is notable given the breadth of investments labels make in long-term artist development, which were detailed earlier in the report, and which span artist relations and strategic support, creative development and production, marketing and distribution. These investments are often high-risk and made without expectation of immediate return.

Artists received 33.5% ($79.9m) of total label revenues.

For every $1 invested by ORCA labels, ~$0.59 is returned directly to artists as revenue.

The majority of profit generated by label investment — 77%— flows directly to artists, underscoring the central role independent labels play in redistributing value back to the people creating the music.

If we reframe this in terms of profit, for every $1 invested by labels, they generate $0.77 in profit after covering their operating costs. Of that profit, approximately $0.59 (or 77%) is paid out to artists, while $0.18 (or 23%) is retained by labels. This breakdown makes clear just how significant this is: the vast majority of profit generated by label investment—77%—flows directly to artists, underscoring the central role independent labels play in redistributing value back to the people creating the music.

While many independent labels around the world face mounting pressures from shifting digital and algorithmic landscapes, as well as increasingly fragmented audiences, the data from participating labels underscores a continued commitment to models that center artist development and revenue sharing. Independent labels are not merely intermediaries; they are critical financial engines that direct the majority of generated profit back to artists. This approach reinforces their unique role in sustaining diverse, long-term artistic careers in an increasingly volatile market.

-

The $79.9m in revenue distributed directly to artists in 2023 breaks down across income streams in proportions that closely mirror the overall revenue structure reported by participating labels. Artist revenues were drawn from streaming (59.51%), physical sales (25.9%), sync licensing (7.4%), downloads (0.96%), merchandise (0.48%), and other sources (5.73%), indicating that artists are benefiting equitably from the same diversified revenue mix that underpins overall label income.

Bon Iver

Case Study

///////

Case Study ///////

Lambrini Girls x City Slang

Interview with Bradley Kulisic, Singing Light Management

Bradley Kulisic owns Singing Light Management, who count Lambrini Girls (signed to ORCA member City Slang Records) as a client. The relationship the band struck with the label was unorthodox. Kulisic outlines: “The band had just recorded a single we had planned for release approximately eight weeks later, regardless of label interest or not. City Slang expressed interest, so I asked about releasing the single with no album commitment first. They said yes, which is a rare bit of flexibility. It worked.”

Lambrini Girls

The band is now signed to the label. Kulisic expands: “City Slang is quite easy compared to some because I’m lucky enough to have decades of UK and global campaign experience and know what it takes to get a band out on the road. It’s that experience as a manager that supports the label and helps the label support the band. We take all their experience and suggestions seriously, but only the band knows exactly what is right for them, and the label gets that; however, lines do sometimes get blurred. A label manager, to me, sits somewhere between a friend and a professional, and I know this can be a tricky area, but it’s handled well, and we’ve appreciated it.”

The first chat with City Slang was in mid-January 2024 (Jan 10 email, Jan 15 first verbal conversation), and the single, 'God's Country' was released Feb 15 - 31 days later. It benefited that the masters, instrumentals, and stems were recorded, so everyone hit the ground running. “We all knuckled down to make that single happen,” adds Kulisic. “It felt exciting to have the stakes of it needing to impact in order to justify the conversation (from both sides). Extra pressure meant extra accountability. There's a time and place where that removal of comfort can be a good thing. We all proved that, and the level of trust from both sides was fantastic. This is not the norm, I believe.”

It has been a busy year for the band. Its debut album, 'Who Let The Dogs Out', broke the UK's top 20 album chart on release in January '25. Six months from the album's release, the band sells out shows pretty much everywhere it goes, with major end-of-year headline gigs across some of Europe's best-known venues. The band has also been nominated for Best Breakthrough Artist at 2025's Heavy Music Awards and for Rising Star at 2023's Rolling Stone Awards.

“Sustaining the label enthusiasm and achieving our goals with it has also been critical to prove the worth and again indicate success. As you may have noticed, the band is ambitious, and that’s been evident since the day I met them. I believe Christof (City Slang Founder) when he says he also believes the same, and in them.”

Bradley Kulisic, Singing Light Management

Artist Career Impact

Label investments across the ORCA cohort not only generate revenue, but also translate directly into measurable growth in artist audiences. For every $1 invested by labels, the data shows an average increase of 0.67 Spotify followers per artist supported, providing a clear link between financial input and fanbase expansion.[24]

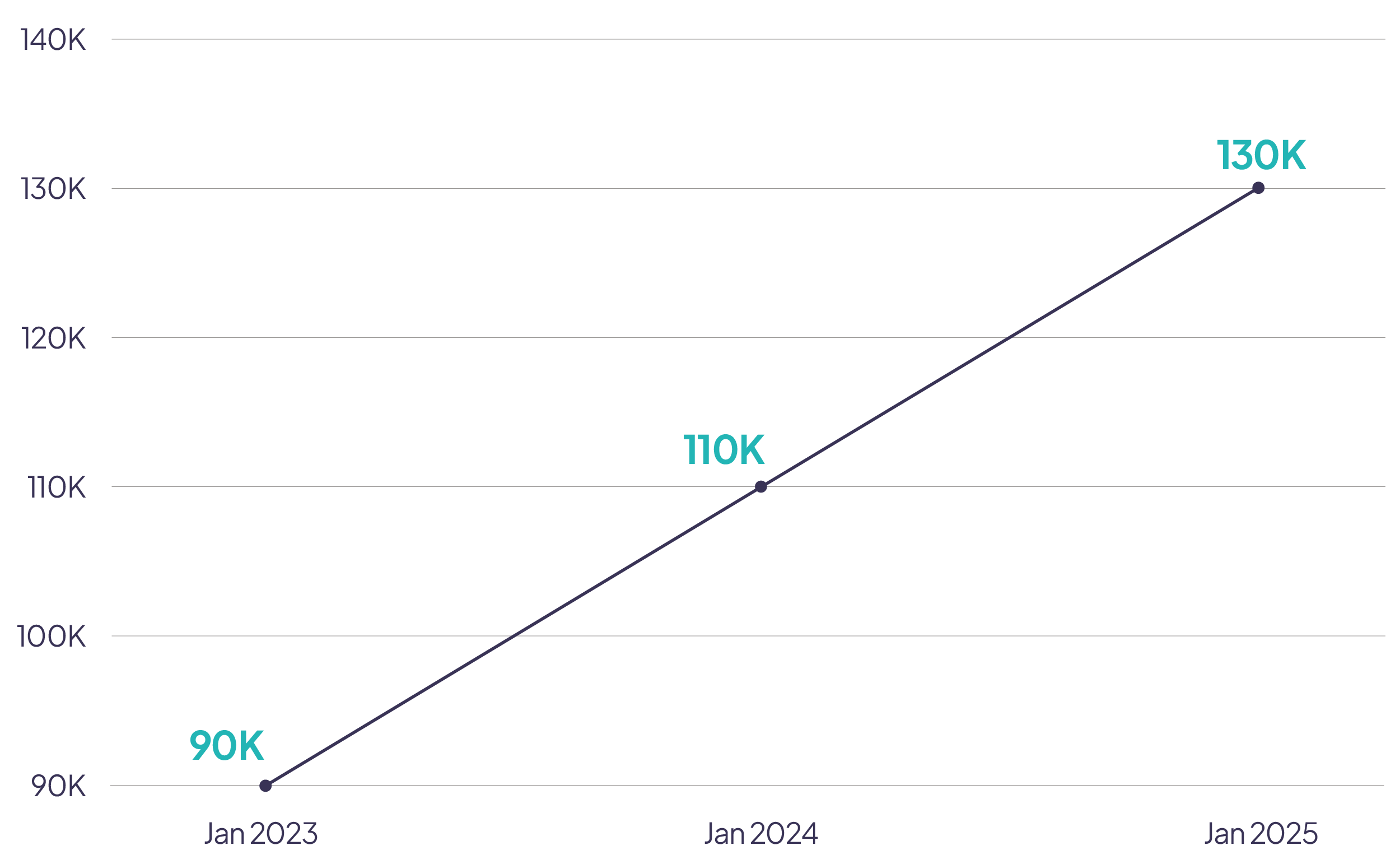

This return on investment in audience development is further reflected in the 44.25% growth in Spotify followers between January 2023 and January 2025, across artists who were supported by the participating labels in 2023 (see figure below).[25] This sustained growth highlights how investments made in a single year continue to deliver impact over time, and further illustrates the sustained developmental approach taken by participating labels. It demonstrates the results of coordinated investment and support, driven by the deep expertise these labels bring to artist development.

For every $1 invested by labels, the data shows an average increase of 0.67 Spotify followers per artist supported.

Between January 2023 and January 2025, the total number of Spotify followers across artists supported by the participating labels in 2023 increased by 44.25%.

Spotify followers (No.)

These findings are especially significant when placed alongside MIDiA’s 2024 State of the independent music economy report, which highlights that 87% of independent labels find it increasingly difficult for their artists to cut through the noise, and 78% report challenges retaining fan interest. Despite these pressures and the competitive environment into which artists are releasing music, the participating labels are nonetheless generating tangible and sustained audience growth for their artists. The steady increase in follower counts suggests that, when deployed effectively and with the long-term picture in mind, independent label investments can overcome the attention bottlenecks and algorithmic volatility that define today’s music platforms.

Crucially, this growth is not just a function of volume, but of focus. As MIDiA notes, more than a third of non-major labels are now concentrating on developing deeper fanbases and working with fewer artists. The results from the ORCA cohort reinforce this shift: long-term artist investment strategies, rather than high-frequency release cycles, are successfully translating into meaningful audience development.

-

The decision to utilize Spotify Followers as the core digital engagement indicator stems from strategic considerations. Spotify's status as the leading global DSP provides a broad and relevant dataset for analysis. Critically, the 'follower' count acts as a valuable proxy for fan base growth and loyalty. It is classified as an 'active' metric because it requires intentional user action (clicking 'Follow'), distinguishing it sharply from 'passive' consumption data like individual streams. This deliberate act implies a deeper connection and a potential long-term relationship between the listener and the artist, making it a useful indicator for assessing the cultivation of a dedicated audience beyond transient interactions or algorithmic recommendations.

-

Based on combined Spotify follower counts across all artists supported by the participating labels in 2023, which increased from 90,024,738 in January 2023 to 129,860,877 by January 2025.